Token management

How share pricing works in Centrifuge and why it matters for your investors.

Why pricing matters

Your share token's price determines:

- What investors pay when they deposit

- What investors receive when they redeem

- The value investors see in their wallets

Unlike traditional funds where you hold "units," Centrifuge uses price-accruing tokens. An investor's token balance stays constant, but the value per token increases as your fund grows.

Example:

- Investor buys 10,000 tokens at 10,000 invested

- Fund grows, NAV increases

- Token price rises to $1.10

- Investor still holds 10,000 tokens, now worth $11,000

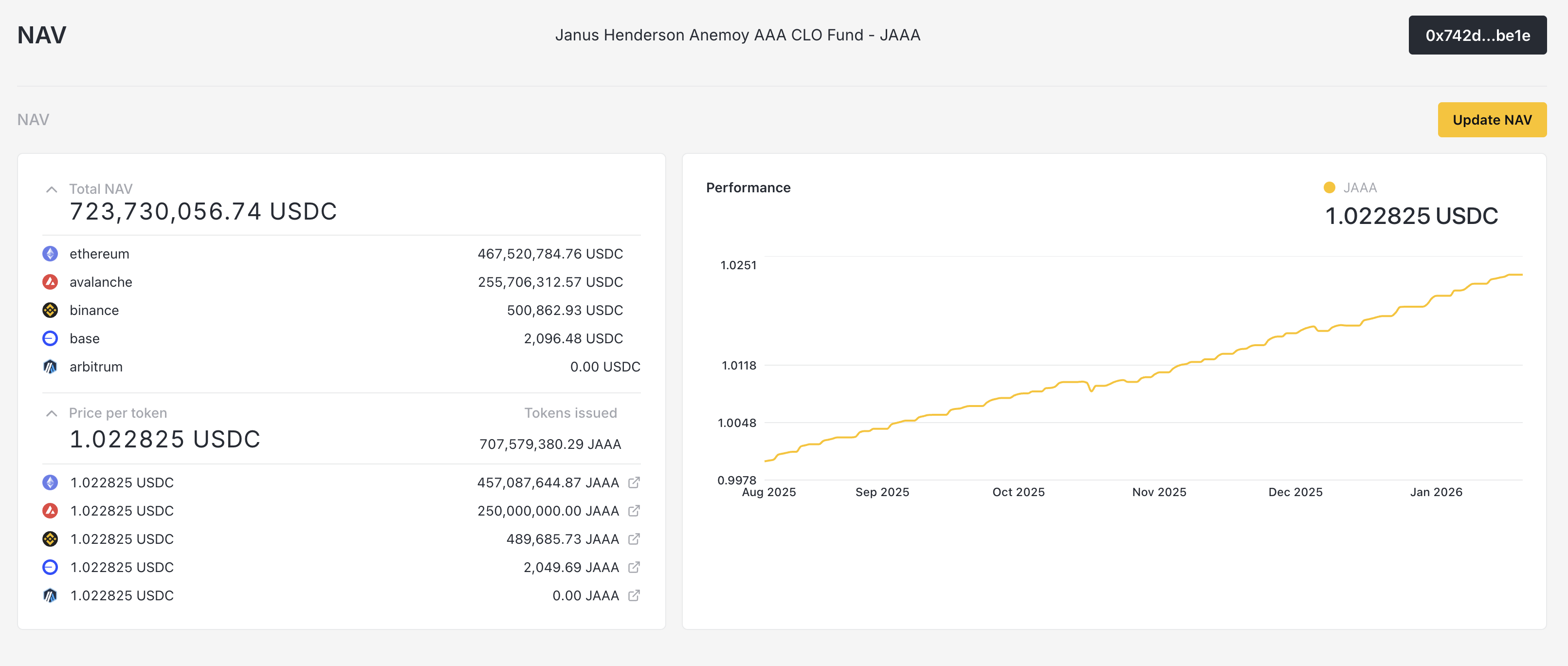

How NAV and price connect

NAV (Net Asset Value) is the total value of all assets backing your share class.

Price per share is calculated automatically:

When you update NAV, the system recalculates the price. This new price is used for all subsequent investments and redemptions.

When to update NAV

Update frequency depends on your underlying assets:

| Asset type | Typical frequency |

|---|---|

| Liquid assets (treasuries, public securities) | Daily |

| Semi-liquid (private credit, loans) | Weekly |

| Illiquid (real estate, infrastructure) | Monthly or quarterly |

Always update NAV before:

- Processing pending investments (so investors get fair pricing)

- Processing pending redemptions (so payouts reflect current value)

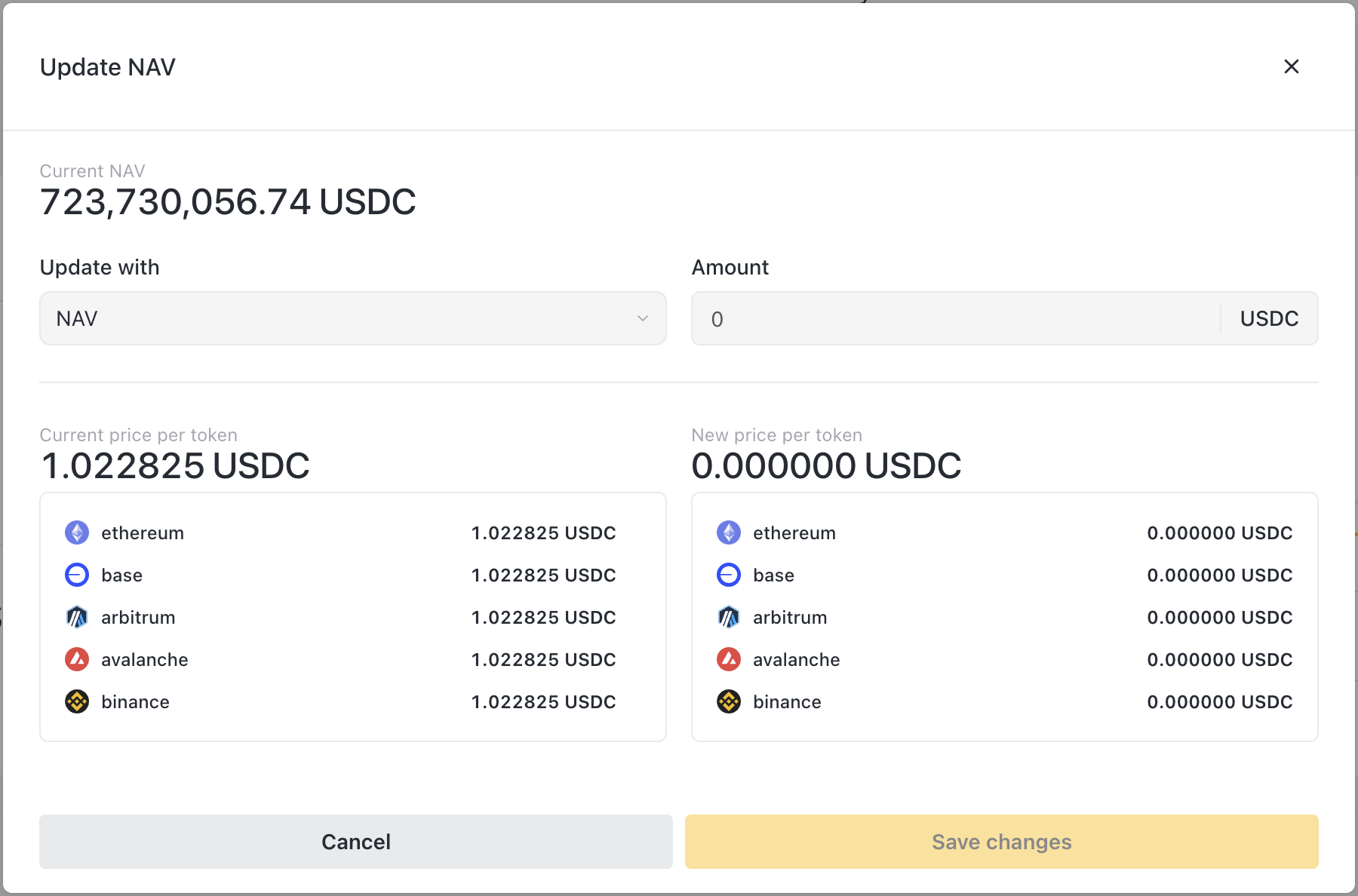

How to update NAV

-

Calculate your current NAV

- Value all underlying assets

- Add accrued income (interest, dividends)

- Subtract fees and expenses

- Sum to get total NAV

-

Update in the app

- Navigate to NAV

- Click Update NAV

- Enter total NAV or target price per share

- Review the price change percentage

- Submit transaction

- Wait for propagation

- Hub chain (Ethereum) updates immediately

- Spoke chains (Base, Arbitrum, etc.) update within ~30 minutes

Multi-chain pricing

Your pool may operate across multiple networks. When you update NAV:

- You update once on the hub chain

- The new price propagates automatically to all spoke chains

- All investors see the same price regardless of which network they're on

This ensures fair, consistent pricing across your entire investor base.

Price and order processing

Investment flow

Investor receives: 10,000 / 1.05 = 9,523 shares

Redemption flow

Investor receives: 5,000 × 1.10 = 5,500 USDC

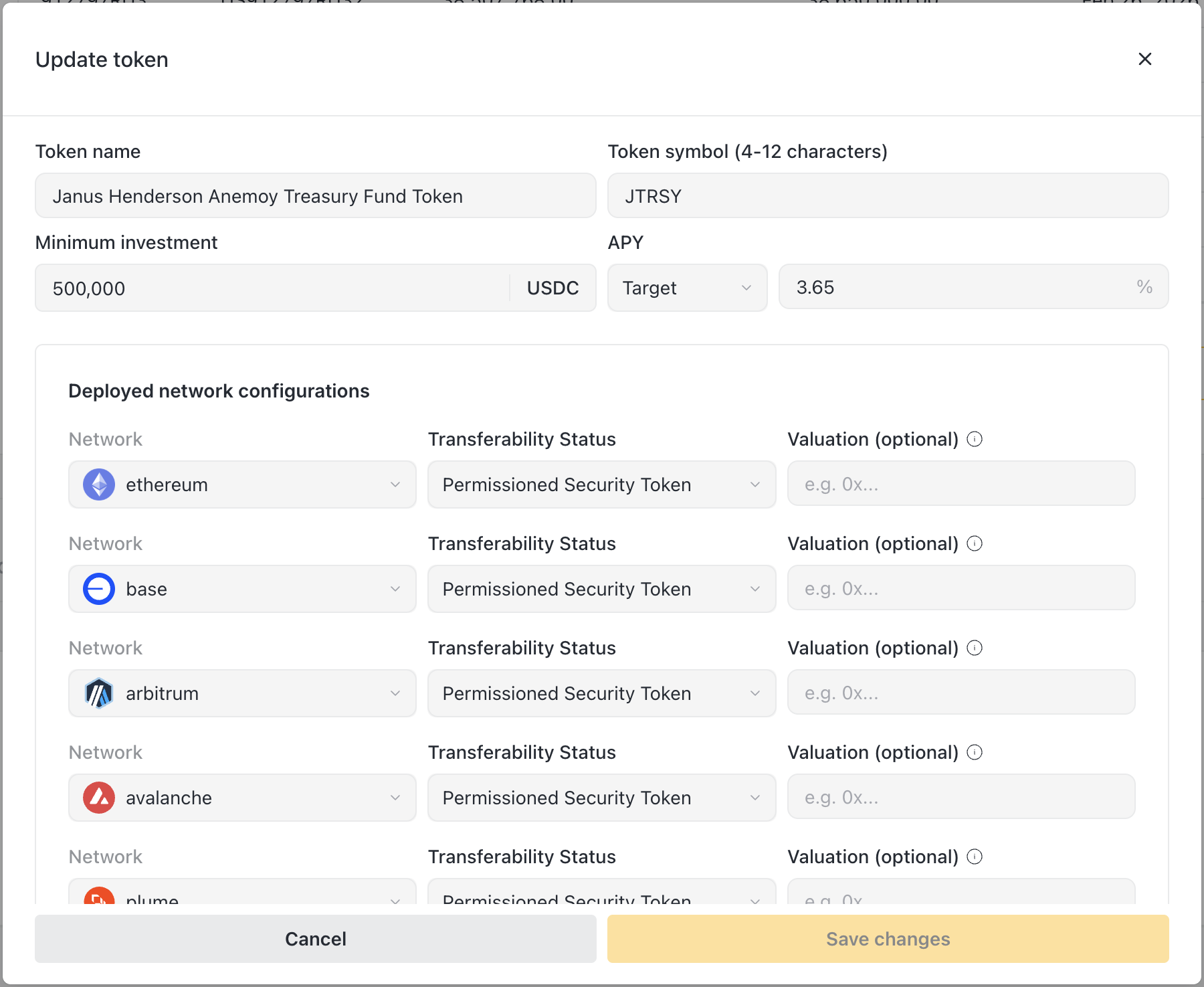

Token types and pricing behavior

Price-accruing tokens (default)

- Token balance stays constant

- Value increases as price rises

- Most common for RWA funds

Rebasing tokens (if configured)

- Token balance increases over time

- Price stays constant (usually $1.00)

- Used for some yield-bearing products

Your token type is set at pool creation.

Best practices

Before updating

- Verify your NAV calculation is accurate

- Check for any pending orders that will process at the new price

- Review the price change - large swings may need explanation to investors

Consistency

- Update on a regular schedule (same time, same day)

- Document your valuation methodology

- Keep records for audit purposes

Communication

- Large price changes may warrant investor communication

- Consider publishing NAV updates to build transparency

Common scenarios

Price dropped - should I still update?

Yes. Accurate pricing protects both you and your investors. Delaying updates to hide losses creates bigger problems later.

Can I update NAV multiple times per day?

Yes, but typically unnecessary. Each update is a transaction with gas costs.

What if I made a mistake?

Update NAV again with the correct value. The most recent update is what counts.

Pending orders and NAV timing

Orders are processed at the price when you issue/revoke shares, not when the investor submitted their request. This gives you control over pricing timing.

Related

- Investor Management - How pricing affects investments and redemptions

- Offering Creation - Setting initial NAV