Investor management

The complete journey from onboarding an investor to processing their redemption.

Overview

Every investor goes through a lifecycle:

As an issuer, you control each step, ensuring compliance, accurate pricing, and smooth operations.

Phase 1: Onboarding

Before investors can access your pool, they need to be verified and whitelisted.

Why onboarding matters

- Compliance - KYC/AML requirements for regulated offerings

- Access control - Only approved investors can hold your tokens

- Audit trail - Record of who can participate

The onboarding flow

Offchain (your responsibility):

- Investor applies to invest

- Investor completes KYC/KYB with your verification provider

- Provider confirms eligibility (accredited investor, jurisdiction, etc.)

- You collect their wallet address

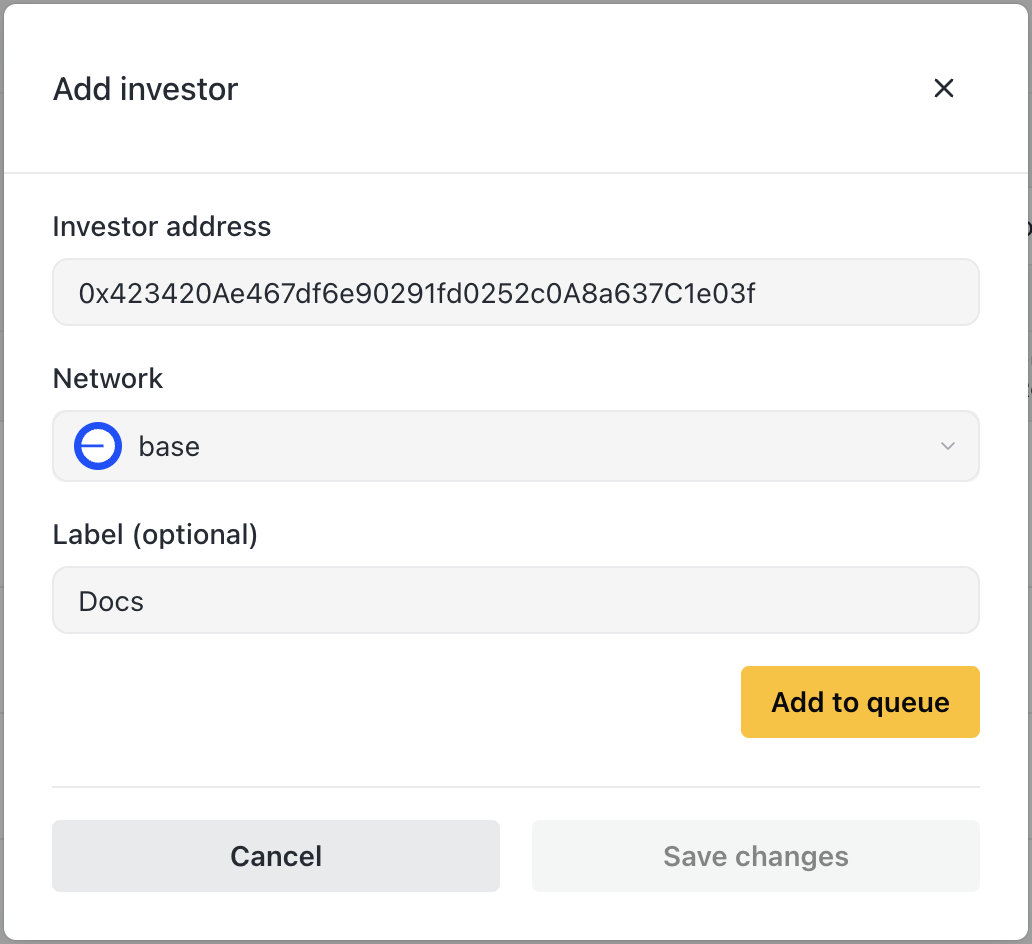

Onchain (in the app):

- Navigate to Investors

- Click Add new investor

- Enter:

- Wallet address

- Network (Base, Arbitrum, etc.)

- Label (e.g., "Acme Capital" for easy identification)

- Save changes

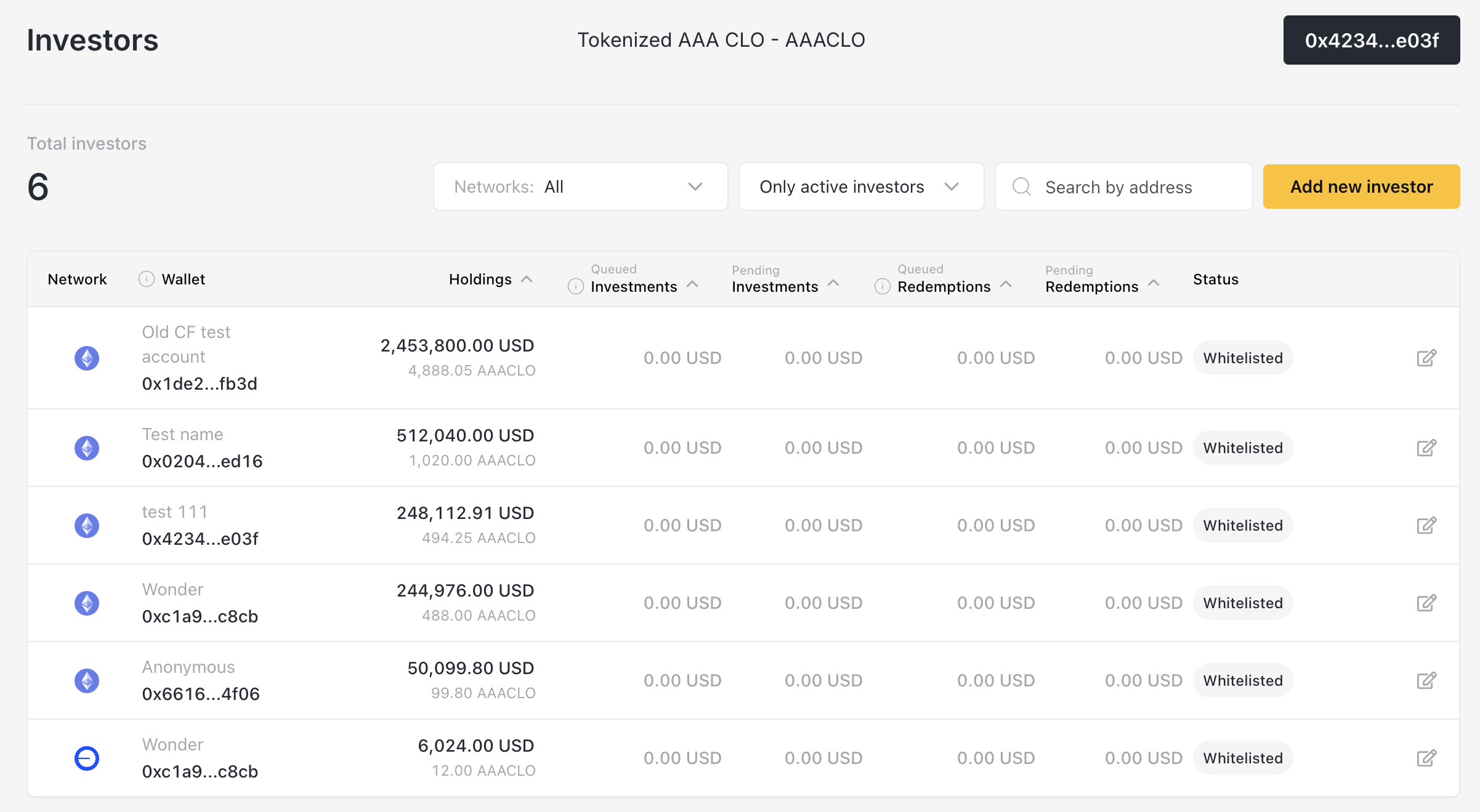

Multi-network whitelisting

Investors must be whitelisted separately for each network they want to use.

Example: If an investor wants to deposit on both Base and Arbitrum:

- Add them once for Base

- Add them again for Arbitrum

This gives you granular control. An investor could be approved for one network but not another.

Communicating with investors

After whitelisting, share:

- The vault contract address for their network

- Any minimum investment requirements

- Instructions for connecting their wallet

Phase 2: Investing

Once whitelisted, investors can deposit funds.

What happens when an investor deposits

- Investor connects to your vault on their chosen network

- Investor approves the asset (USDC, etc.) for the vault contract

- Investor submits their deposit amount

- Order appears in your app under Orders → Pending Investments

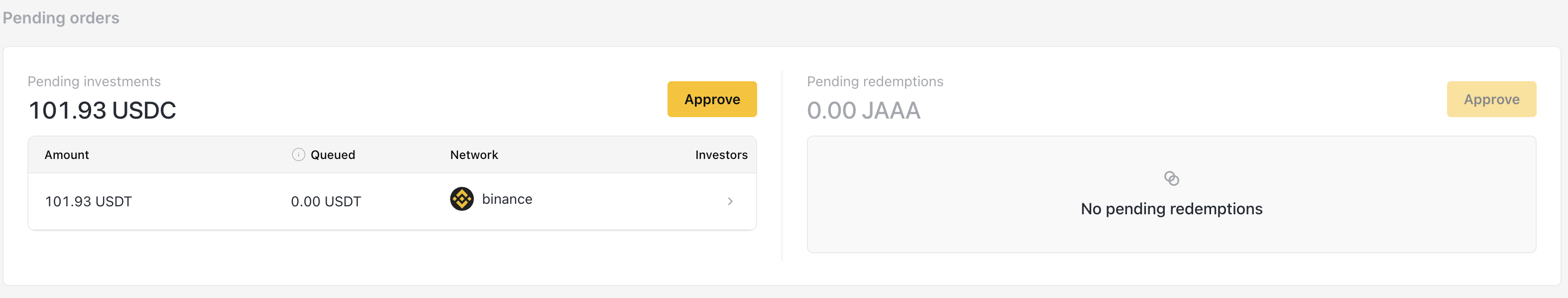

Your role: Approve and issue

Step 1: Review pending investments

- Check investor addresses

- Verify amounts

- Note which network/asset

Step 2: Update NAV

- Ensure pricing is current before issuing shares

- See Token Management

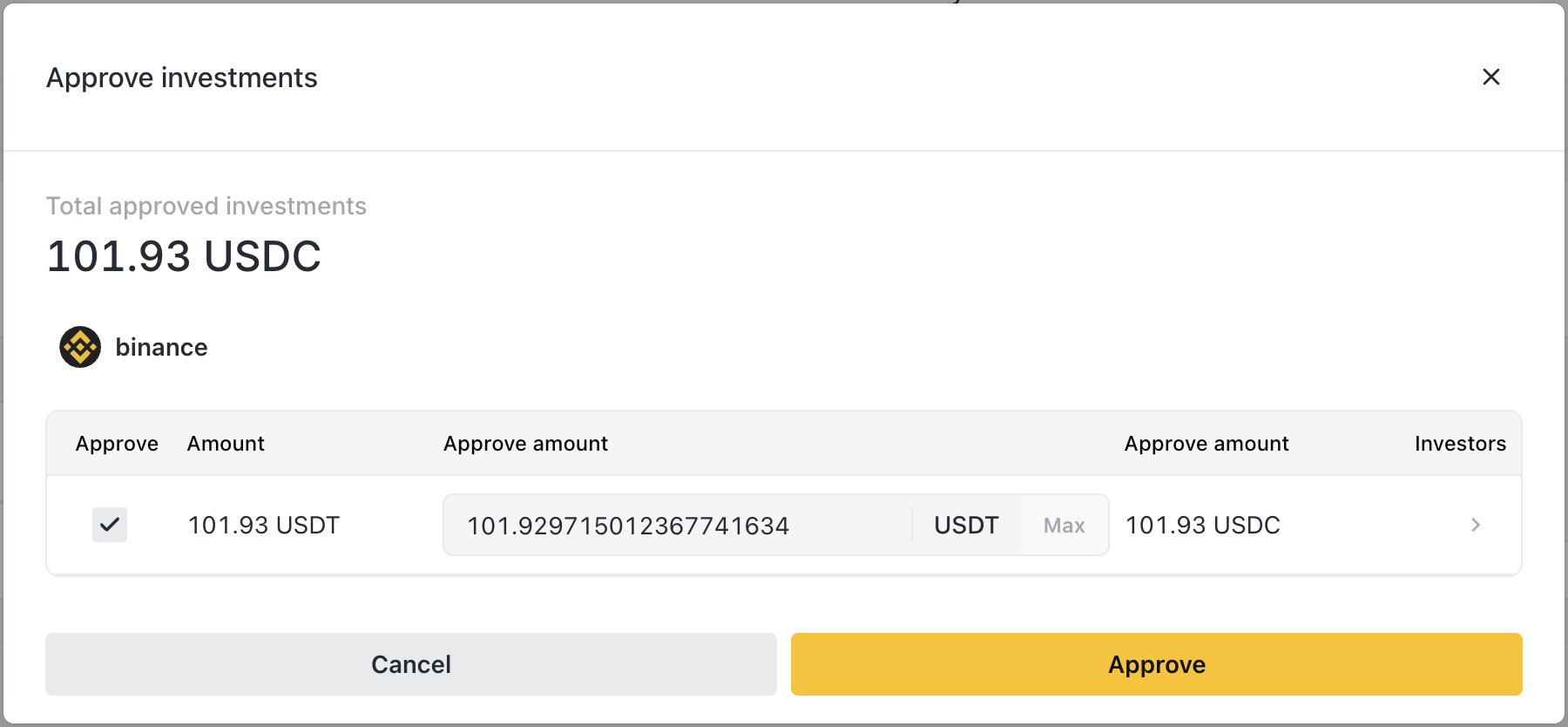

Step 3: Approve

- Navigate to Orders

- Click Approve in Pending Investments

- Select orders to approve

- Submit transaction

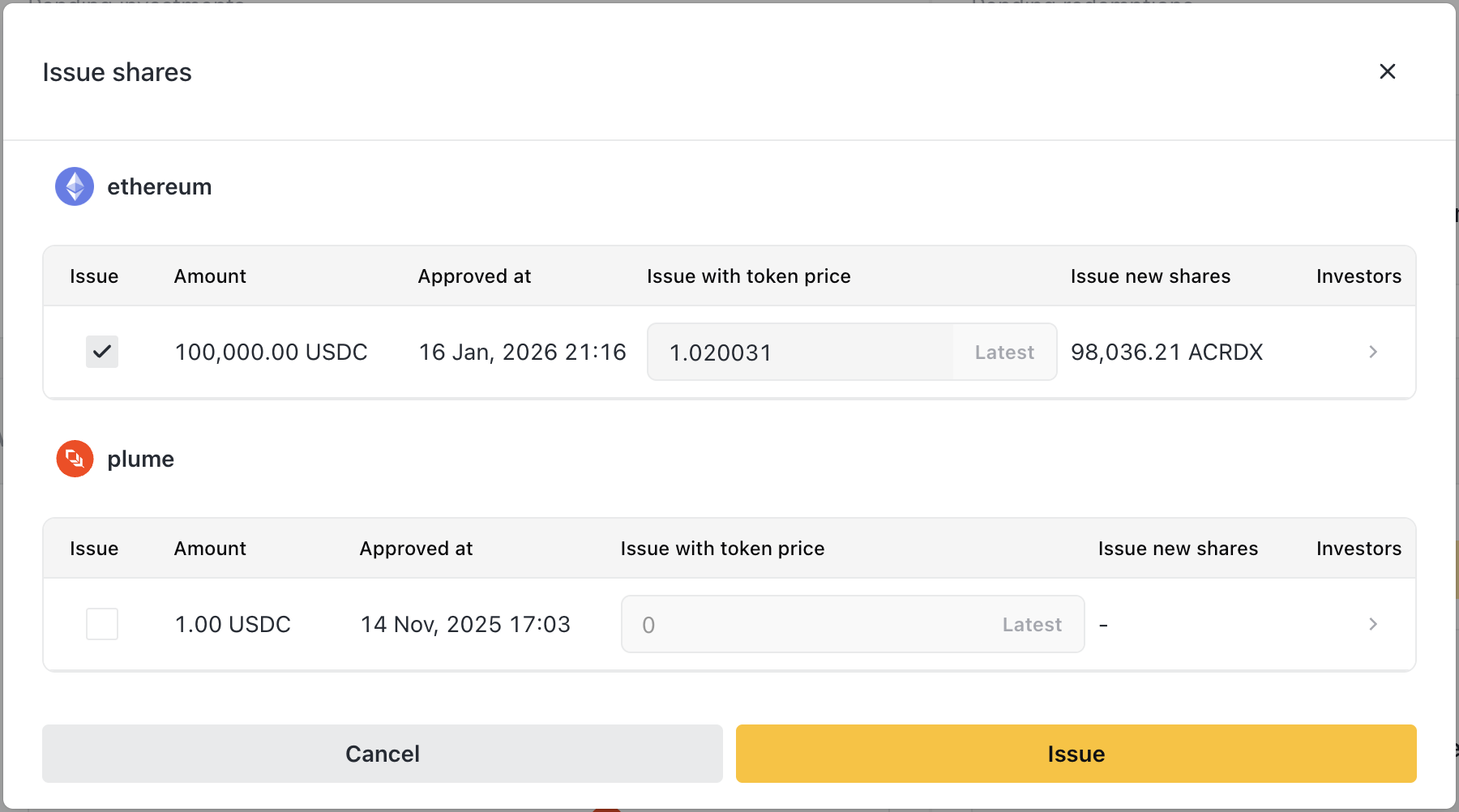

Step 4: Issue shares

- Click Issue in Approved Investments

- Confirm the price per share

- Submit transaction

Result: Investor receives share tokens in their wallet.

Share calculation

Example:

- Investor deposits 100,000 USDC

- Current price: $10.00

Async vs Sync vaults

Async vaults (ERC-7540): You control when shares are issued. Deposits queue until you approve.

Sync-Invest vaults (ERC-4626): Shares are issued instantly when investors deposit. Less control, but better UX for liquid strategies.

Phase 3: Holding

While investors hold your tokens, their value accrues based on NAV updates.

What investors experience

- Token balance stays constant

- Token value increases as you update NAV

- Portfolio view shows current value in their wallet

Your ongoing responsibilities

- Update NAV regularly to reflect accurate value

- Monitor investor activity for any issues

- Manage compliance - freeze investors if needed

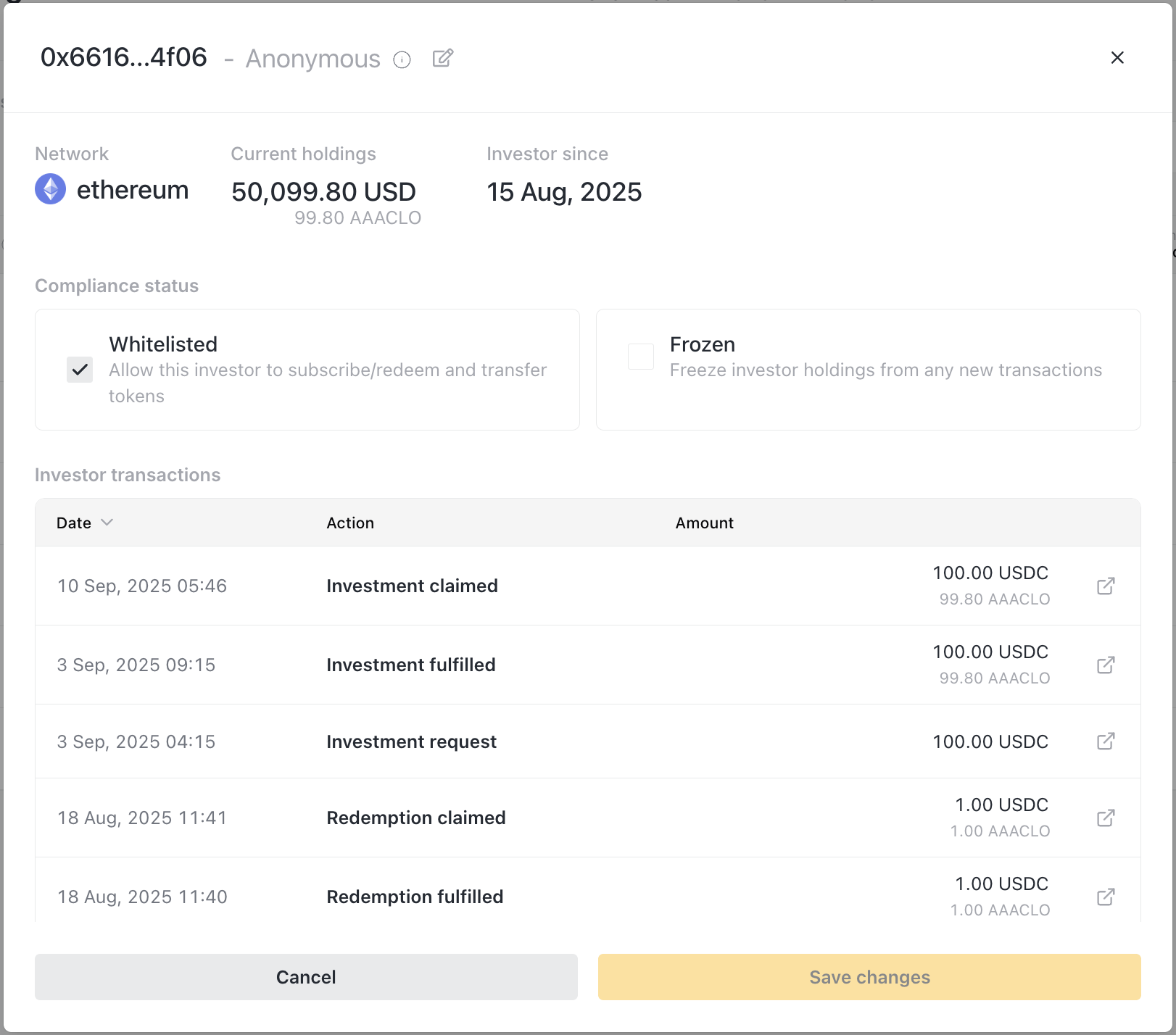

Freezing an investor

If you need to temporarily block an investor:

- Navigate to Investors

- Click on the investor row

- Toggle Freeze

- Confirm

Frozen investors:

- Keep their existing holdings

- Cannot make new deposits

- Cannot submit redemption requests

- Can be unfrozen anytime

Use for: compliance holds, suspicious activity, pending investigations.

Phase 4: Redeeming

When investors want to exit, they submit redemption requests.

What happens when an investor redeems

- Investor submits redemption request for X shares

- Order appears in your app under Orders → Pending Redemptions

- You approve the redemption

- You revoke shares and send payout

Your role: Approve and pay out

Step 1: Review pending redemptions

- Check shares being redeemed

- Calculate estimated payout

- Verify sufficient holdings balance

Step 2: Check liquidity

- Navigate to Holdings

- Ensure you have enough assets to cover the payout

- If not, deposit more before proceeding

Step 3: Update NAV

- Ensure pricing is current for fair payout

- See Token Management

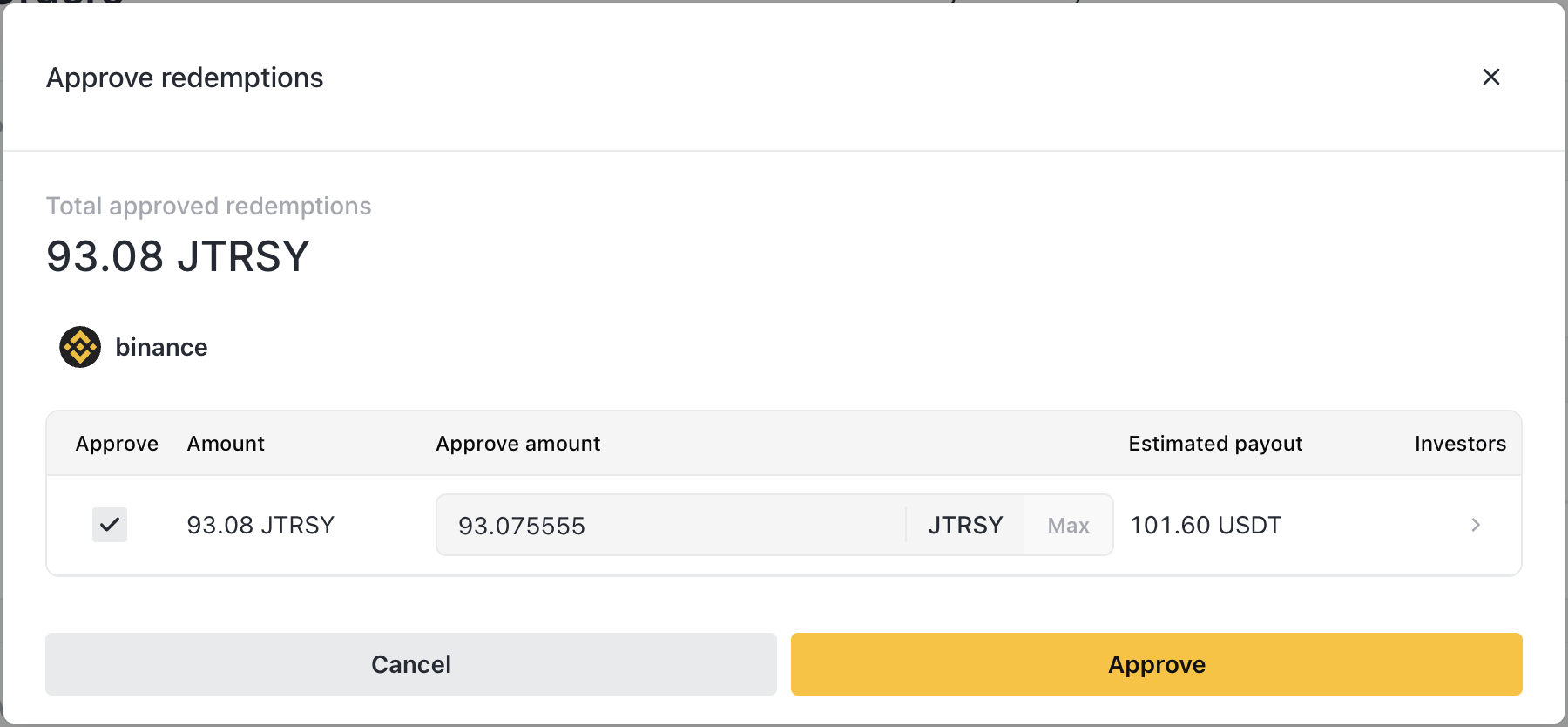

Step 4: Approve

- Navigate to Orders

- Click Approve in Pending Redemptions

- Select orders to approve

- Submit transaction

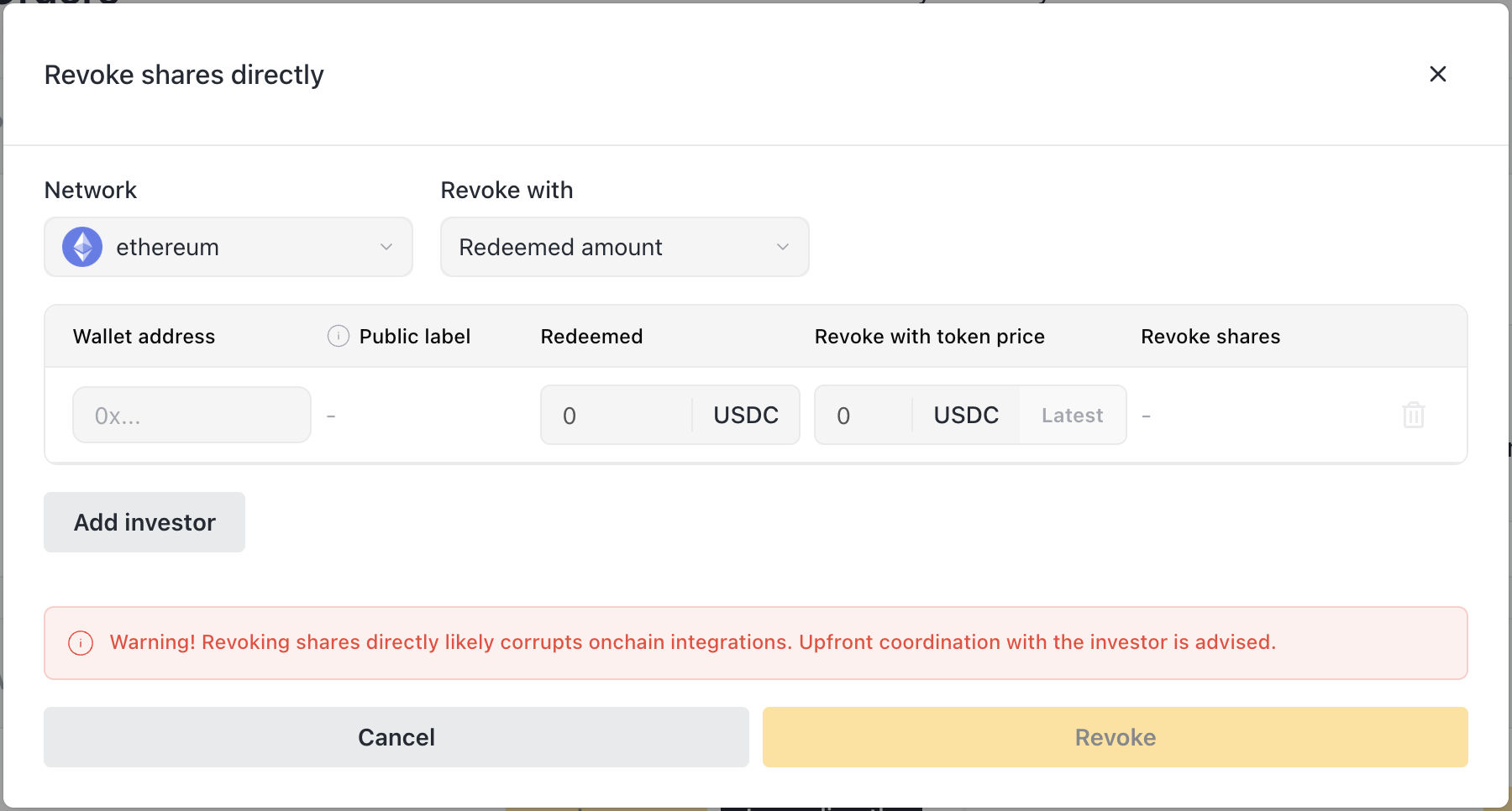

Step 5: Revoke shares

- Click Revoke in Approved Redemptions

- Confirm the price per share

- Submit transaction

Result: Shares are burned, investor receives payout.

Payout calculation

Example:

- Investor redeems 5,000 shares

- Current price: $11.00

Partial redemptions

Investors can redeem part of their holdings:

- Redeem 5,000 of 10,000 shares

- Keep remaining 5,000 shares

- Continue holding and can redeem more later

Phase 5: Exit

When an investor fully redeems, they exit the pool.

Full redemption

- All shares are burned

- Full payout sent

- Investor's token balance goes to zero

- They remain whitelisted (can invest again later)

Removing an investor

If you want to fully remove access:

- Ensure all pending orders are processed

- Navigate to Investors

- Click on the investor row

- Click Remove from whitelist

- Confirm

Removed investors:

- Keep any existing holdings (if not fully redeemed)

- Cannot make new deposits

- Cannot submit new redemption requests (but pending ones still process)

Complete example

Acme Capital invests and later redeems:

| Step | Action | Result |

|---|---|---|

| Day 1 | You whitelist Acme on Base | Acme can now deposit |

| Day 2 | Acme deposits 100,000 USDC | Pending investment appears |

| Day 3 | You update NAV ($10/share), approve, issue | Acme receives 10,000 shares |

| Day 30 | NAV grows, price now $10.50 | Acme's holdings worth $105,000 |

| Day 60 | Acme requests redemption of 5,000 shares | Pending redemption appears |

| Day 61 | You update NAV ($11/share), approve, revoke | Acme receives 55,000 USDC, keeps 5,000 shares |

| Day 90 | Acme redeems remaining 5,000 shares | Acme receives 55,000 USDC, fully exited |

Handling edge cases

Investor wants to transfer to another wallet

Direct transfers may be restricted by your token settings. Options:

- Investor redeems from old wallet

- Whitelist new wallet

- Investor deposits from new wallet

Investor lost access to their wallet

Work with the investor on recovery. You cannot move tokens on their behalf. They must have wallet access.

Large redemption exceeds holdings

Options:

- Deposit more funds to holdings

- Process partial redemption

- Coordinate with investor on timing

Related

- Token Management - Pricing investments and redemptions

- Distribution Management - Ensuring you can pay redemptions