Offering creation

Launch your first tokenized offering on Centrifuge in five steps.

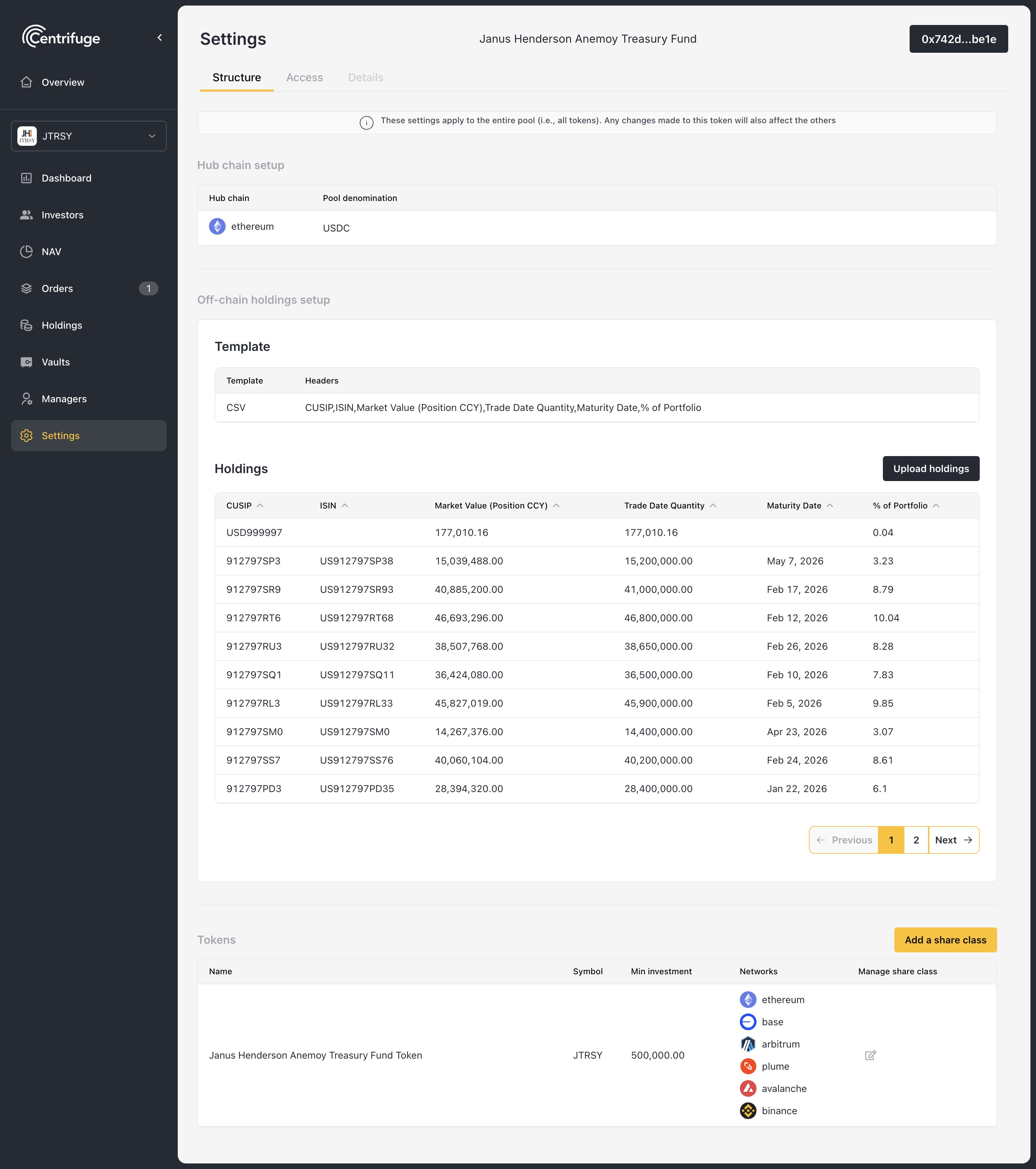

Step 1: Create your pool

Go to manage.centrifuge.io and configure:

- Share class - Name, symbol, minimum investment

- Restrictions - Who can hold tokens (whitelist, open, etc.)

- Hub Managers - Addresses with full admin access

Deploy when ready.

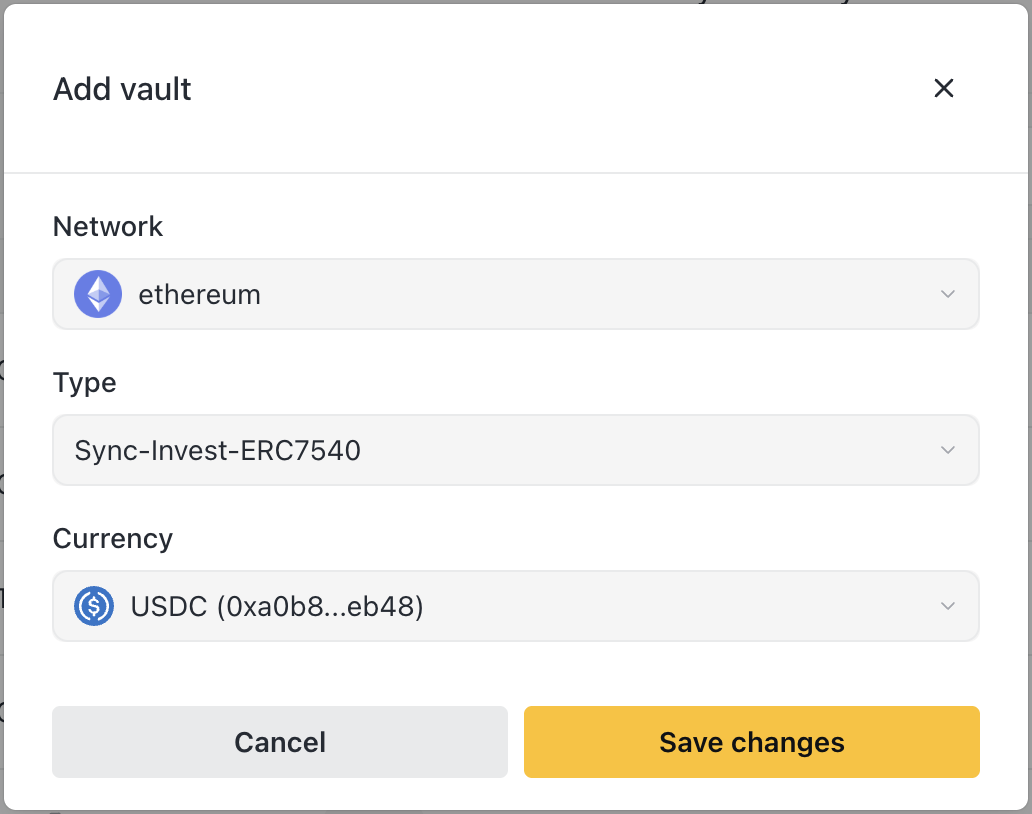

Step 2: Deploy vaults

Vaults are where investors deposit. Create one per network you want to support:

- Navigate to Vaults

- Click Add vault

- Choose network, asset, and vault type

- Deploy

Vault types:

- Async - You approve deposits before issuing shares

- Sync-Invest - Instant deposits (you still approve redemptions)

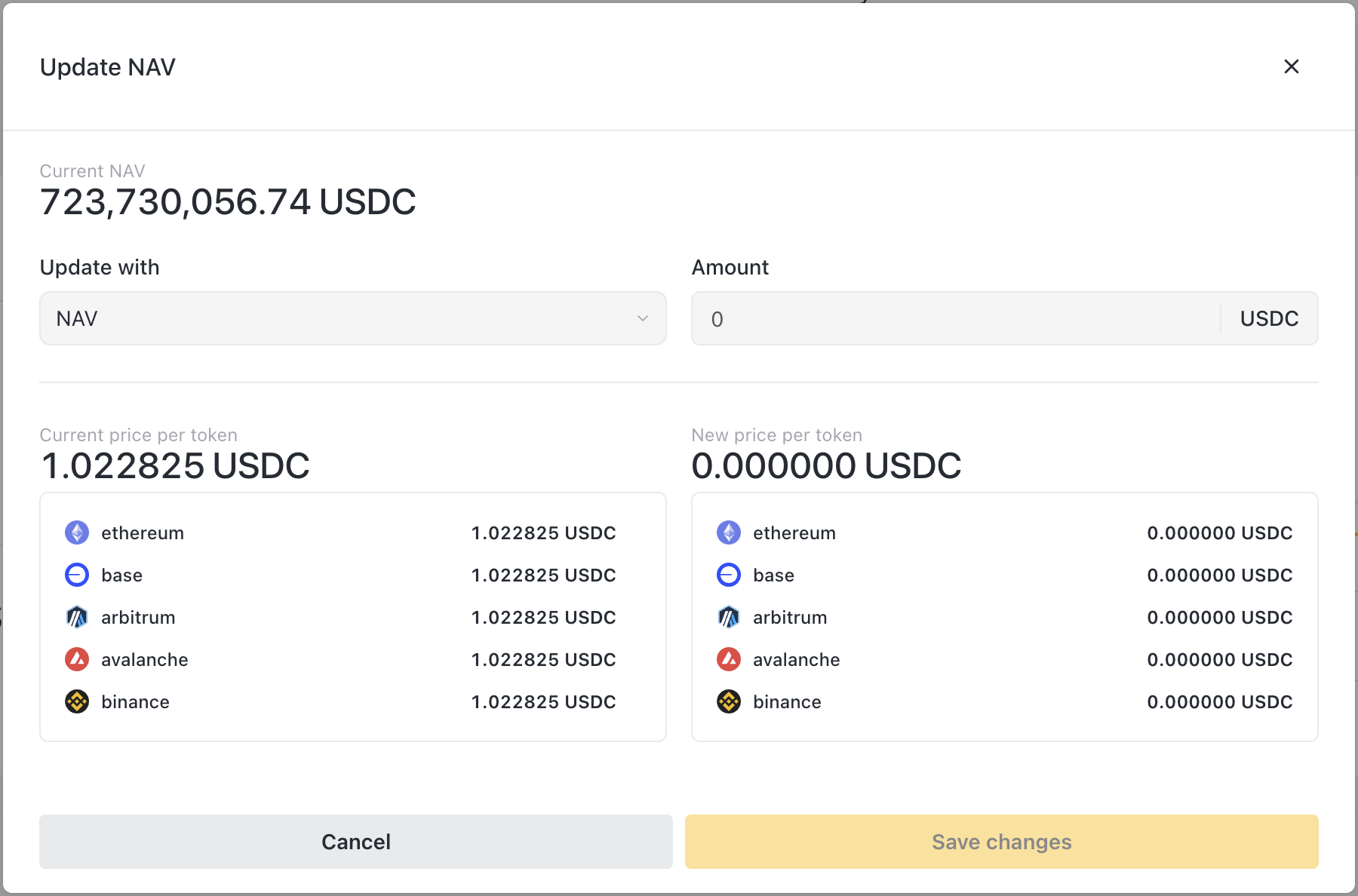

Step 3: Set initial NAV

Set your starting price before accepting investors:

- Navigate to NAV

- Click Update NAV

- Enter initial price (typically $1.00 for new funds)

- Submit

→ Learn more: Token Management

Step 4: Add your team

Configure who can do what:

| Role | What they do |

|---|---|

| Hub Manager | Everything - NAV, orders, investors, settings |

| Balance Sheet Manager | Move funds, direct issue/revoke |

| Relayer | Withdraw to off-ramp addresses |

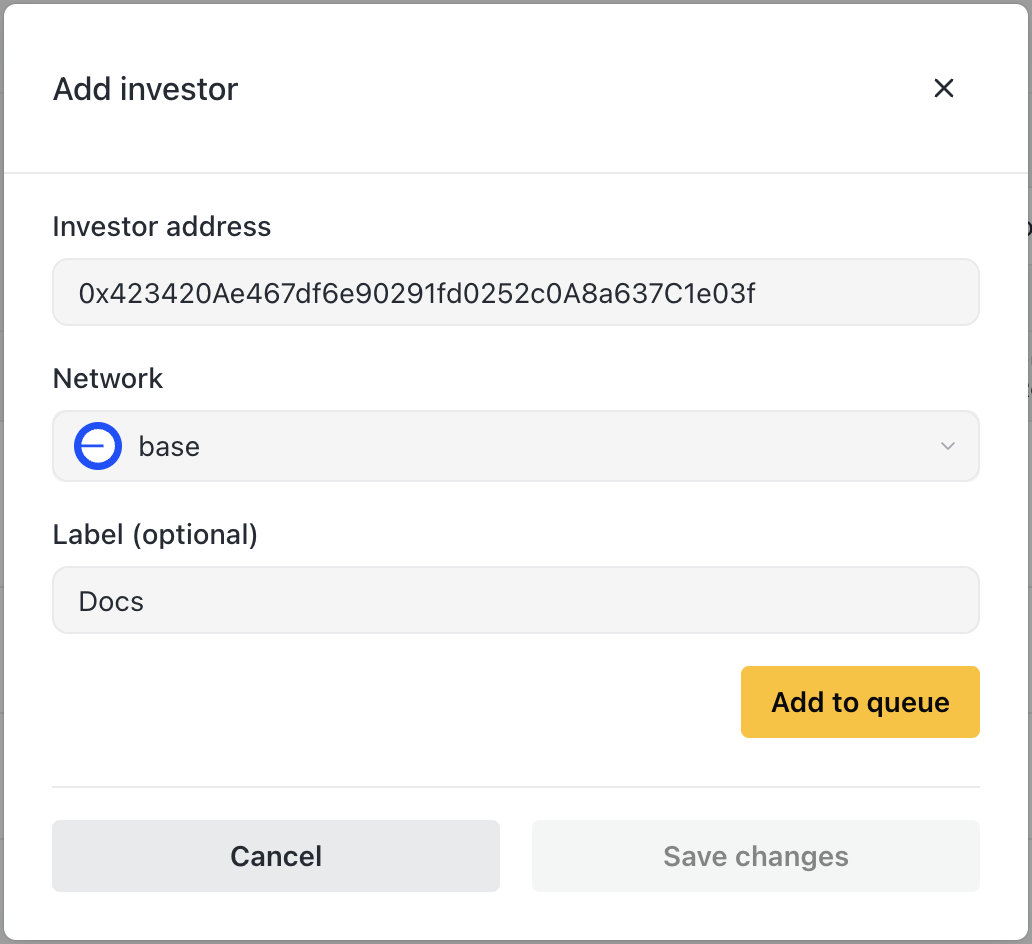

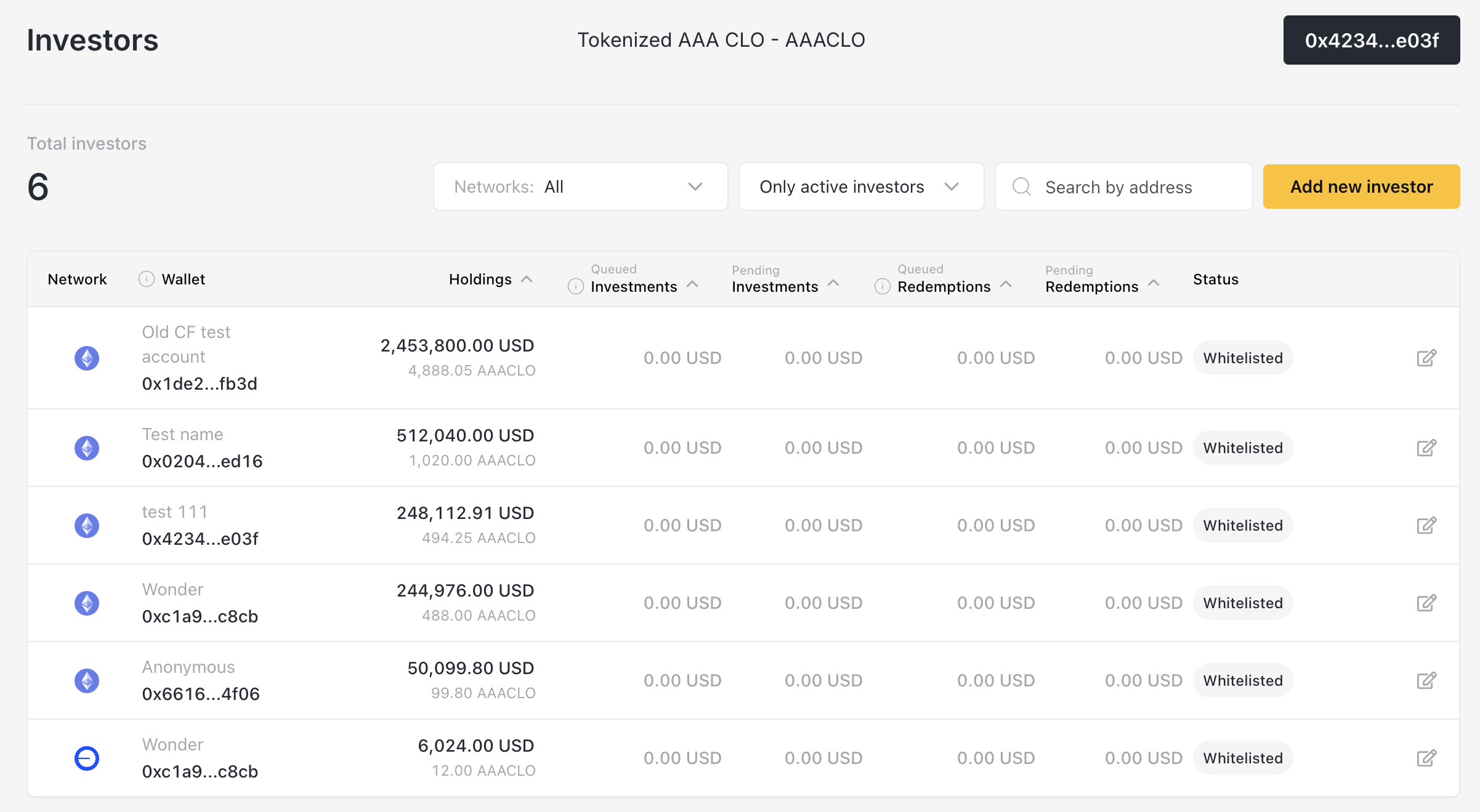

Step 5: Whitelist investors (if permissioned)

- Navigate to Investors

- Click Add new investor

- Enter wallet address, network, and label

- Save

→ Learn more: Investor Management

You're live

Once investors deposit, your workflow is:

- Update NAV regularly (daily/weekly based on your assets)

- Approve investments and issue shares

- Approve redemptions and process payouts

- Manage liquidity to ensure you can pay redemptions

Next steps

| Guide | What you'll learn |

|---|---|

| Investor Management | Onboarding → investing → redeeming |

| Token Management | How share pricing works, when to update |

| Distribution Management | Holdings, on/off-ramp, paying redemptions |